Real-World Benefits

Real Benefits, Real Results

Quantifiable and Real-World Benefits

Efficiency ratio

improvement

Revenue increase improvement

Reduction in cost per loan and operating costs

Reduction in time to close and fund a commercial credit

Results with certainty

AFSVision is the only proven solution for your credit and lending modernization.

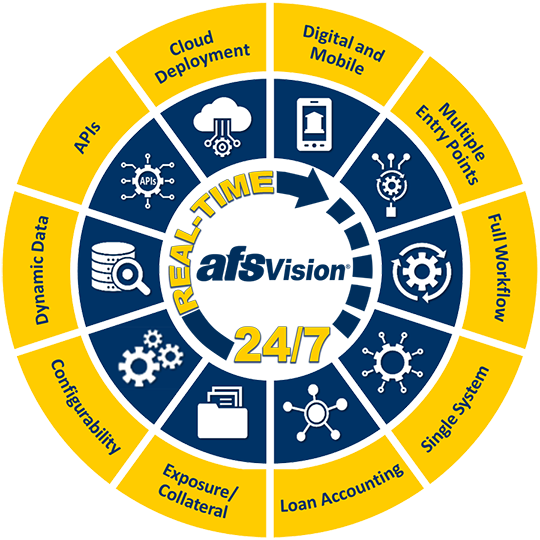

From local to global financial institutions, AFS solutions provide these key elements you need to compete in today’s digital lending environment:

- One system for all lines of business

- Complete lending and credit lifecycle management support

- End-to-end integrations and APIs for your digital strategy

- Cloud-enabled technology for deployment options

- Real-time, 24/7, anywhere access to your entire portfolio for better/faster decisioning

- Multicurrency and multilingual capabilities

- The agility and scalability to support an unlimited number of products, loan types, and volumes

- Integrated reporting tools for consolidated management-information reporting

- Proven execution, flexible implementation, and scalable project management

- Dedication to innovation and market leadership to stay ahead of market headwinds

- The industry’s premiere assembly of financial and technology experts

- A dedicated partner for success

Real-world success with AFSVision.

AFSVision’s single digital system design and built-in integration capabilities meets the demands of worldwide credit and commercial lending by enabling efficient management throughout the lending lifecycle.

-

Provide a better customer experience.

Through digitalization, online banking integration, less data entry, auto fee assessment, and significant reduction in attrition losses, you get significantly faster close/fund times and your customers get the experience they’ve come to expect in today’s world. -

Improve your customer processes.

Designed to enable seamless end-to-end management, AFVision streamlines processes and improves data quality, leading to increased efficiency and productivity. With our cloud options, APIs, and web services, you have everything you need to streamline your processes.

-

Mitigate your risk.

AFSVision's integrated reporting tools provide powerful insight into portfolio activity, pricing, industry concentration, total customer and market segment exposure, credit exceptions, runoff, and revenue leakage, enabling well-informed business decisions that fuel growth, optimize yield, and identify issues before they derail your business goals.

-

Increase efficiency and revenue.

Slow closing times, unclaimed fees, and missed renewals are all too common. By supporting automated lifecycle management and providing a holistic, real-time view of lending and credit data you’ll be able to satisfy customer expectations while increasing revenue to the bottom line.

-

Adapt and grow.

AFSVision's flexible, agile, and real-time system is designed to adapt easily to client growth and market changes, enabling you to meet market and customer demands. This means with AFSVision you can make quicker loan decisions, offer “hot topic” products (i.e., ESG lending) quickly, and stay ahead of market and regulatory changes, all while keeping pace with you as you grow.

-

Choose the right partner.

Choosing the right partner is just as important as choosing the right technology. For more than 50 years, we have serviced the banking industry with a singular focus on commercial lending. Our strategic clarity, continuous evolution, and unsurpassed experience translate not only into the most innovative solutions in the industry, but a 100% success rate in delivering successful implementations.

Get in Touch