data you can trust

AFSVision IRIS

The Right Data, When You Need it

AFSVision makes data-driven decisions easier with IRIS.

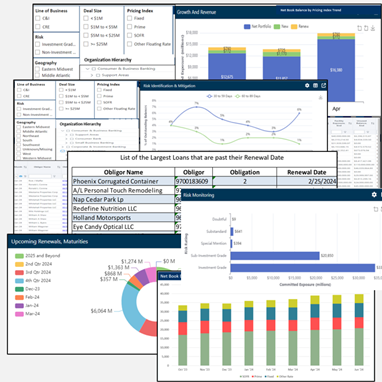

Bring your commercial lending portfolio into focus with AFSVision’s integrated, dashboard-enabled reporting hub IRIS!

With comprehensive, intuitive reporting and data extraction capabilities, IRIS provides powerful insights into new business activity, customer retention, risk identification and mitigation, and monitoring of portfolio credit quality. Decision-ready reports help you manage exceptions and outliers, identify concentrations of credit, optimize portfolio yield, and proactively manage lending risk.

Designed for any functional area

Gain clarity through integrated, unified reporting.

Designed for any functional area – front, middle, and back office— in need of AFSVision commercial loan information, this powerful, intuitive dashboard allows you to:

- Quickly identify potential areas of concern or items requiring follow up

- Drill into summary data on reports to see real-time customer information

- Build your own dashboards and display business results with ease

- Access and organize list reports by common filters including organizational hierarchy, product type, and more

Empower Your Business Growth with Actionable Data Insights

AFSVision IRIS provides a view into key performance indicators, which are central to the effective management of the enterprise portfolio.

Increase revenue.

Enhance revenue by:- Views centered on deterioration of credit quality

- Aggressively tracking, and managing upcoming maturities and renewals

- Providing trend data on key metrics to facilitate strategic decisions

- Maximizing fee contributions to overall client profitability

- Filter data to identify which organizational units, groups of customers, or credit products are most profitable, including the ability to drill down into the details to determine the underlying causes of performance.

Mitigate credit risk.

IRIS provides proactive risk management reporting for indicators such as nonaccruals, risk-rating distributions, and industry concentrations, as well as unlimited user-defined ad hoc views to target early warning signals of emerging credit quality issues.

Improve productivity and efficiency.

Relationship managers and support staff can improve productivity with IRIS by gathering the information they need to manage risk, including:- Early identification of problem loans

- Emerging concentrations of credit

- Total customer exposure

- Changes in risk ratings

An integrated part of AFSVision, IRIS can make a difference for your organization. Schedule a demo to learn more.

Get in Touch