transforming commercial lending

Solutions

the only solution you need

The modern digital solution for commercial lending.

Transform your commercial lending portfolio with AFSVision, the fully integrated, digital, commercial lending solution that modernizes how you manage your entire commercial lending portfolio—all on one system.

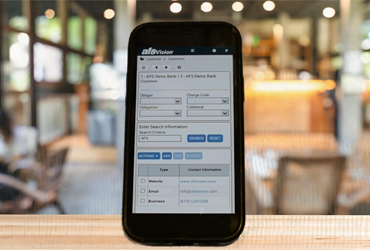

The agile solution for the 2020s and beyond.

Years ahead of our competitors’ solutions, AFSVision provides our clients with the only commercial lending system designed to be at the center of the digital experience. Modernize your business by enabling AFSVision’s real-time, fully mobile and digital commercial lending platform to improve your speed of response to:

- Client requests

- Credit approval decisions

- Risks and exposures

- Market fluctuations

- Industry trends

- Regulatory demands

-

Commercial

Commercial

Lending -

Commercial

Commercial

Real Estate -

Small Business

Small Business

SBA -

Agriculture

Agriculture

Lending -

Capital

Capital

Markets -

Wealth

Wealth

Management

Lending

Commercial Lending

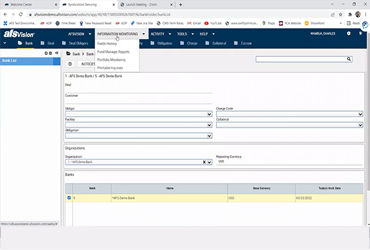

Realize the advantage of a single system.

AFSVision’s single-system design, built-in APIs, and unique real-time capabilities provides unparalleled agility, control, and support encompassing all lines of business, from simple Small Business loans to complex Syndications.

Real Estate

Commercial Real Estate Lending

A better way to manage CRE lending.

The only complete solution that offers fully integrated, real-time management and reporting, AFSVision’s real-time servicing and risk management engine enables end-to-end integration throughout the lending process. Our clients are able to easily manage the intense data requirements of CRE lending while maximizing and growing your portfolio.

SBA

Small business

Streamline your process without sacrificing flexibility.

Lending

Agriculture Lending

Streamline agriculture lending with real-time flexibility.

Markets

Capital Markets

Gain control, minimize risk.

With AFSVision’s fully automated digital management capabilities, our clients get the operational controls and efficiencies to minimize risk so they can focus on growing their syndications portfolio without having to increase resources.

Management

Wealth Management

Sophisticated credit and lending management.

With a sophisticated set of credit and lending management tools, AFSVision streamlines and enhances wealth management lending, offering the high-level of service you, and your high-net worth clients, expect.

-

“AFSVision is one of the leading commercial lending platforms on the market, and it is well suited to accelerating our Core Banking Modernization project.” said Dixiana Berrios, Executive Vice President and Chief Operating Officer at Metropolitan Commercial Bank. “In addition to meeting all our current needs, this platform will enable us to execute our ongoing and future strategic initiatives. Metropolitan Commercial Bank’s expertise and experience will enhance AFSVision’s implementation, enabling continued growth, improved client experience, higher profitability, and stronger risk management.”

Dixiana Berrios

Executive Vice President and Chief Operating Officer -

“We are looking forward to leveraging the rich data available through the Credit Risk Navigator (CRN) database,” said John Dravenstott, Portfolio Executive at KeyBank. “Portfolio benchmarking and peer analytics is a core component of our risk management framework, and we found that the CRN database provides unique depth and granularity of data in the commercial space.”

John Dravenstott

Portfolio Executive -

“AFS is an industry leader in providing commercial lending system solutions. The AFSVision platform will help Huntington continue to innovate to best serve our customers with the flexibility to meet changing customer needs now and in the future. We appreciate AFS’ partnership and commitment to excellence in serving our customers.”

John Largent

Executive Vice President and Commercial Operations Director -

“We know that to continue to win and grow, we must constantly evolve and adapt. Choosing a forward-looking replacement for our commercial and syndicated loan systems, we needed a company whose philosophy matched ours, and we found that in AFS,” said Jude Schramm, Chief Information Officer, Fifth Third Bank. “We know our selection of AFSVision will accelerate our digital transformation initiative while enabling growth, profitability, risk management, and a better experience for our customers.”

Jude Schramm

Chief Information Officer -

“AFS has a singular focus on commercial lending and a proven track record of delivering on time and on budget. We look forward to AFS providing us with the agility we need to efficiently enhance client servicing and experience.”

-

“AFS was not just a vendor and trusted advisor but a true value-added partner. AFS did what they said they would, and at the cost they said they would. At no point did anyone on the project lose sleep over AFS.”

Joel Hill

Past Head of Commercial Credit Operations

supporting your strategy

Why AFS?

Our singular focus on commercial lending brings strategic clarity, continuous innovation, and unsurpassed experience in offering clients the modern solutions they need to compete.

-

APIs

AFSVision includes an extensive set of existing, rich RESTful APIs and DIY APIs to integrate with internal and external systems, enabling a seamless end-to-end experience.

-

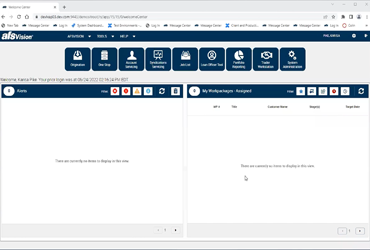

Workflows

AFSVision’s powerful, imbedded workflows guide work throughout the loan lifecycle, with flexibility to respond to your shifting priorities, changing timelines, and market demands.

-

True Real-Time 24/7

A true real-time, on demand, digitally enabled solution, AFSVision provides up-to-the-second, accurate portfolio data to enable better decisioning and exceptional customer service.

-

Controls

AFSVision has imbedded reporting tools to help quickly and easily get a precise overview with drill-down capabilities on your entire commercial lending portfolio.

-

Cloud Native

Containerized, scalable, and secure by design, AFSVision’s cloud native, cloud agnostic design provides the same robust capabilities and benefits whether on the public cloud or the AFSVision Hosted Private Cloud.

-

Scalability

Designed to scale horizontally and vertically, AFSVision’s robust and stable platform scales proportionately as you grow—we have never failed to meet capacity or experienced a failure.

-

Standard Product

AFSVision is designed to be a standard, maintainable, and configurable solution, reducing overhead, complexity, and barriers to growth and technology evolution.

-

Proven

A reliable and innovative partner for 50+ years, AFS has a proven track record of delivering on commitments—on time and on budget.

innovative features