Loan Pricing Benchmarking

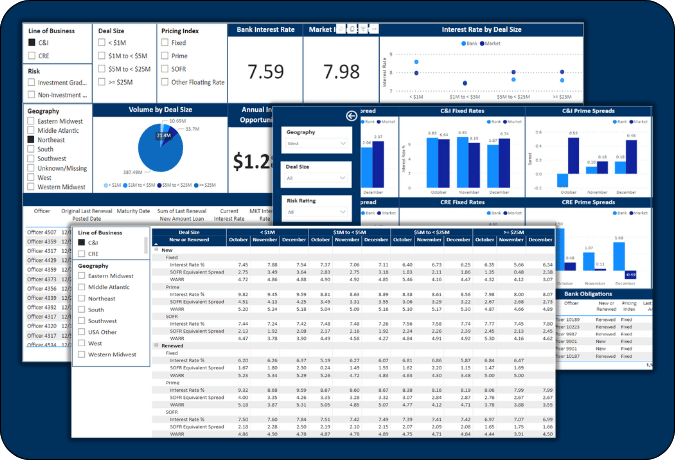

AFS Pricing Dashboard

Benchmark your performance

Manage commercial loan pricing with precise, timely, and affordable monthly benchmarks.

In any type of economy, it all comes down to how you price your loans. Informed by the industry’s most comprehensive pricing trends database, the AFS Pricing Dashboard gives you a unique combination of market data, monthly reporting, and consulting services to maximize your commercial loan pricing practices.

The most robust and timely database in the industry.

The strength of our competitive loan pricing information begins with the depth, breadth, and reporting cadence of the AFS Pricing Database, including:

-

Robust Database

Independently verified, regionally representative, and statistically significant in identifying risk-return opportunities. -

Monthly Trends and Content

Expertly curated data and analysis on an opaque lending market. -

Ability to Easily Segment

Online query capability through which data can be viewed by size, geography, loan type, and many other segments to easily compare pricing performance.

Optimize loan pricing using the AFS Pricing Dashboard’s monthly, curated data.

Powered by the AFS Pricing Database, the AFS Pricing Dashboard enables analytics for segmentation and drill-down on upcoming renewals, new/renewed deals, and pricing performance. Designed using key drivers of price sensitivity, the AFS Pricing Dashboard is an invaluable tool to feed pricing models, set pricing ranges/targets, and recalibrate loan pricing minimums or guidelines.

Unique value drivers of the AFS Pricing Dashboard:

- Real facts on commercial loan pricing – market benchmarks on deal flow, interest rates, and spreads based on a robust and granular market practice database.

- Dissect market trends by key pricing levers – geographic region, deal size, risk segment, etc.

- Proprietary SOFR-equivalent spread measure to normalize pricing comparisons between banks and provide a holistic view of spread pricing.

- Empower RMs with aspirational pricing targets, including market-equivalent interest rates for individual bank loans along with top-quartile performance benchmarks.

- Quantify the interest income opportunity of raising prices to the market average level and above.

- Retention analytics by comparing pricing on upcoming renewals to prevailing market rates.

- Risk indicators to reveal pockets of stress in a volatile marketplace.

“The only reports my people trust come from the AFS Pricing Dashboard. The monthly charts keep us abreast of all the top industry trends.”

Insights from industry-recognized experts.

Drawing on the most powerful benchmarking analytic and reporting services available, AFS Business Intelligence provides monthly charts and complementary webinars based on the latest trends in commercial lending that provide insights and tactics critical to navigating the market’s constantly evolving drivers.

- AFS publishes the AFS Pricing Charts of the Month, providing an overview of the latest trends in commercial loan characteristics.

- AFS periodically hosts complementary pricing trend webinars, where we examine trends in commercial loan pricing.

Get in touch

.png?height=250&name=Pricing%20Charts%20of%20the%20Month_Feb%20(1).png)