Support for Success

AFS Services

Analyze, Report, Train, and Test

We support your success.

Capitalizing on our 50 years of experience in the commercial lending marketplace, AFS delivers the information, services and support you need to realize your goals and mitigate risk. With best-in-class testing processes, industry-leading training, and the largest commercial lending database our clients get the services they need to succeed.

services that make a difference

Delivering the tools to minimize risk.

Our cutting-edge testing procedures, unparalleled training programs, and access to the extensive commercial lending database ensure that our clients receive top-notch services tailored to their success.

- AFS Pricing Service

- AFS Pricing Dashboard

- Credit Risk Navigator

- Test Automation as a Service

- AFS eLearning

Pricing Service

In any type of economy, it all comes down to how you price your loans. With the AFS Loan Pricing Service database you receive a unique combination of market data, monthly reporting, and consulting services to maximize your commercial loan pricing practices.

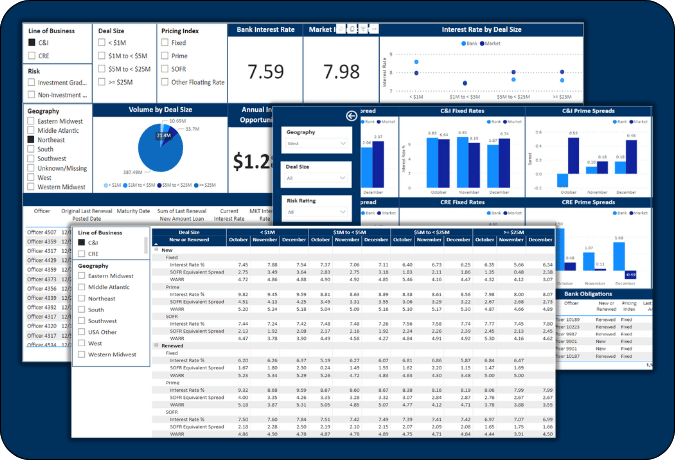

Pricing Dashboard

No matter the state of the economy, effective loan pricing is crucial. The AFS Pricing Dashboard, powered by the industry's most comprehensive pricing trends database, provides unparalleled market data, monthly reports, and consulting services. This unique combination helps you optimize your commercial loan pricing strategies to achieve the best results.

Credit Risk Navigator

The ProSight Credit Risk Navigator (CRN), powered by AFS, is the industry’s next-generation commercial credit risk service. With a one-of-a-kind monthly reporting cadence, extensive data granularity, customizable reporting, and an intuitive dashboard, CRN provides the best commercial credit metrics resource for bank leadership.

Test Automation as a Service

There’s risk, and a lot of necessary workforce and time required, in adopting new or upgrading your commercial lending technology. With AFS Test Automation as a Service, we take care of regression testing based on your specific environments and timelines. Let us focus on testing so that you can continue working toward your commercial lending goals.

AFS eLearning

Training users is one of the major hurdles when implementing a new system. The learning curve can be steep and delay your return on investment.

With AFS eLearning courseware, users can lay the groundwork in understanding all that AFSVision has to offer with self-paced, online training in AFSVision Account Servicing, Post-Approval Workflow, and Loan Administration Workflow.